utah county food sales tax

We weight these numbers according to Census 2010 population figures to give a sense of. The tax on grocery food is 3 percent.

What Is The Tax Rate On Food In Utah This Lawmaker Wants It To Be Zero Deseret News

If you do not have a Utah sales tax licenseaccount report the use tax on line 31 of TC-40.

. If the vendor has a permanent sales tax license the vendor must report and remit the sales tax from the event on Form TC-790C in addition to reporting it on the vendors regular sales tax returns. Sales Tax Clearinghouse publishes quarterly sales tax data at the state county and city levels by ZIP code. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here.

The maximum local tax rate allowed by Pennsylvania law is. The maximum local tax rate allowed by Missouri law is. State regional and county information.

State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town. The Pierce County Washington sales tax is 930 consisting of 650 Washington state sales tax and 280 Pierce County local sales taxesThe local sales tax consists of a 280 special district sales tax used to fund transportation districts local attractions etc. Utah is one of just 13 states that still includes groceries at least partially in their sales tax bases noted Jared Walczak vice president of state projects with the Tax Foundation in.

Not exempt from MN sales tax on food beverages and lodging. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Missouri has a statewide sales tax rate of 4225 which has been in place since 1934.

The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. County tax may apply. Grocery food is food sold for ingestion or chewing by humans and consumed for taste or nutrition.

The Pierce County Sales Tax is collected by the merchant on all qualifying sales made within Pierce County. Municipal governments in Pennsylvania are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 0166 for a total of 6166 when combined with the state sales tax. Utah Economic Data Viewer is a tool for studying occupations profiling occupational wages quantifying industry employment and wages finding firms downloading unemployment rate information and exploring population estimates.

Exemption extends to sales and use tax on meals and hotel occupancy. If a locality within a county is not listed with a separate rate use the county rate. Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy.

For purchases 1000 provide vendor with Utah Sales Tax Exemption Contract TC-73 PDF Form expires 7202019. Pennsylvania has a statewide sales tax rate of 6 which has been in place since 1953. Municipal governments in Missouri are also allowed to collect a local-option sales tax that ranges from 05 to 7763 across the state with an average local tax of 3679 for a total of 7904 when combined with the state sales tax.

The Nassau County Sales Tax is collected by the merchant on all qualifying sales made. Sales for special events should be included in the gross sales reported on Line 1 of the regular sales tax return. Special event sales should.

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Business Guide To Sales Tax In Utah

Utah Sales Tax Rates By City County 2022

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

The Best And Worst States For Taxes West Virginia Virginia Country Roads

Is Food Taxable In Utah Taxjar

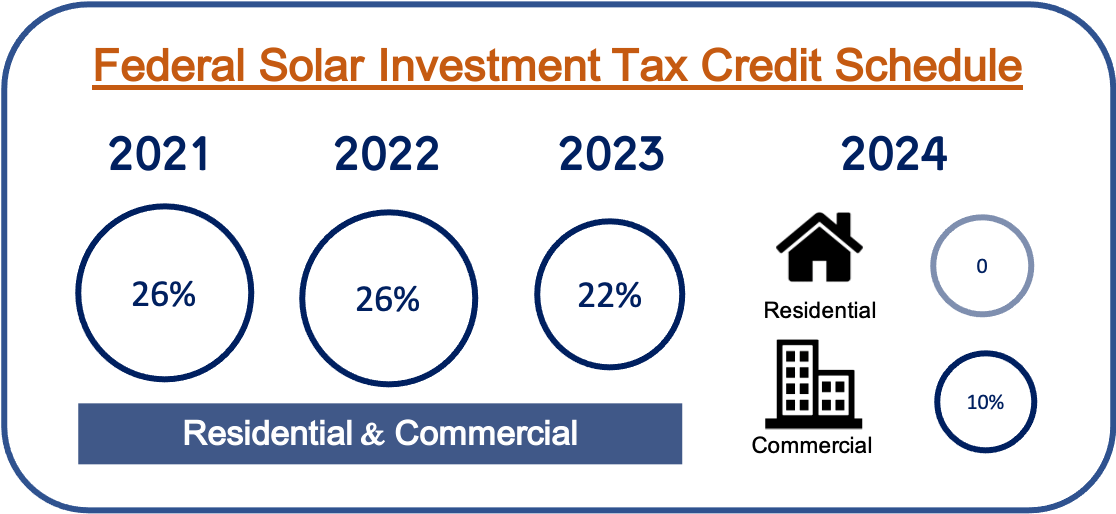

Solar Incentives In Utah Utah Energy Hub

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax On Grocery Items Taxjar

Up To 50 Off Gourmet Pizza Gourmet Pizza Pizza Gourmet

Real Estate Humor Real Estate Quotes Real Estate Humor Real Estate Fun